Friday, May 17. 2013

Landlords Double as Energy Brokers

-----

Equinix’s data center in Secaucus is highly coveted space for financial traders, given its proximity to the servers that move trades for Wall Street.

The trophy high-rises on Madison, Park and Fifth Avenues in Manhattan have long commanded the top prices in the country for commercial real estate, with yearly leases approaching $150 a square foot. So it is quite a Gotham-size comedown that businesses are now paying rents four times that in low, bland buildings across the Hudson River in New Jersey.

Why pay $600 or more a square foot at unglamorous addresses like Weehawken, Secaucus and Mahwah? The answer is still location, location, location — but of a very different sort.

Companies are paying top dollar to lease space there in buildings called data centers, the anonymous warrens where more and more of the world’s commerce is transacted, all of which has added up to a tremendous boon for the business of data centers themselves.

The centers provide huge banks of remote computer storage, and the enormous amounts of electrical power and ultrafast fiber optic links that they demand.

Prices are particularly steep in northern New Jersey because it is also where data centers house the digital guts of the New York Stock Exchange and other markets. Bankers and high-frequency traders are vying to have their computers, or servers, as close as possible to those markets. Shorter distances make for quicker trades, and microseconds can mean millions of dollars made or lost.

When the centers opened in the 1990s as quaintly termed “Internet hotels,” the tenants paid for space to plug in their servers with a proviso that electricity would be available. As computing power has soared, so has the need for power, turning that relationship on its head: electrical capacity is often the central element of lease agreements, and space is secondary.

A result, an examination shows, is that the industry has evolved from a purveyor of space to an energy broker — making tremendous profits by reselling access to electrical power, and in some cases raising questions of whether the industry has become a kind of wildcat power utility.

Even though a single data center can deliver enough electricity to power a medium-size town, regulators have granted the industry some of the financial benefits accorded the real estate business and imposed none of the restrictions placed on the profits of power companies.

Some of the biggest data center companies have won or are seeking Internal Revenue Service approval to organize themselves as real estate investment trusts, allowing them to eliminate most corporate taxes. At the same time, the companies have not drawn the scrutiny of utility regulators, who normally set prices for delivery of the power to residences and businesses.

While companies have widely different lease structures, with prices ranging from under $200 to more than $1,000 a square foot, the industry’s performance on Wall Street has been remarkable. Digital Realty Trust, the first major data center company to organize as a real estate trust, has delivered a return of more than 700 percent since its initial public offering in 2004, according to an analysis by Green Street Advisors.

The stock price of another leading company, Equinix, which owns one of the prime northern New Jersey complexes and is seeking to become a real estate trust, more than doubled last year to over $200.

“Their business has grown incredibly rapidly,” said John Stewart, a senior analyst at Green Street. “They arrived at the scene right as demand for data storage and growth of the Internet were exploding.”

Push for Leasing

While many businesses own their own data centers — from stacks of servers jammed into a back office to major stand-alone facilities — the growing sophistication, cost and power needs of the systems are driving companies into leased spaces at a breakneck pace.

The New York metro market now has the most rentable square footage in the nation, at 3.2 million square feet, according to a recent report by 451 Research, an industry consulting firm. It is followed by the Washington and Northern Virginia area, and then by San Francisco and Silicon Valley.

A major orthopedics practice in Atlanta illustrates how crucial these data centers have become.

With 21 clinics scattered around Atlanta, Resurgens Orthopaedics has some 900 employees, including 170 surgeons, therapists and other caregivers who treat everything from fractured spines to plantar fasciitis. But its technological engine sits in a roughly 250-square-foot cage within a gigantic building that was once a Sears distribution warehouse and is now a data center operated by Quality Technology Services.

Eight or nine racks of servers process and store every digital medical image, physician’s schedule and patient billing record at Resurgens, said Bradley Dick, chief information officer at the company. Traffic on the clinics’ 1,600 telephones is routed through the same servers, Mr. Dick said.

“That is our business,” Mr. Dick said. “If those systems are down, it’s going to be a bad day.”

The center steadily burns 25 million to 32 million watts, said Brian Johnston, the chief technology officer for Quality Technology. That is roughly the amount needed to power 15,000 homes, according to the Electric Power Research Institute.

Mr. Dick said that 75 percent of Resurgens’s lease was directly related to power — essentially for access to about 30 power sockets. He declined to cite a specific dollar amount, but two brokers familiar with the operation said that Resurgens was probably paying a rate of about $600 per square foot a year, which would mean it is paying over $100,000 a year simply to plug its servers into those jacks.

While lease arrangements are often written in the language of real estate,“these are power deals, essentially,” said Scott Stein, senior vice president of the data center solutions group at Cassidy Turley, a commercial real estate firm. “These are about getting power for your servers.”

One key to the profit reaped by some data centers is how they sell access to power. Troy Tazbaz, a data center design engineer at Oracle who previously worked at Equinix and elsewhere in the industry, said that behind the flat monthly rate for a socket was a lucrative calculation. Tenants contract for access to more electricity than they actually wind up needing. But many data centers charge tenants as if they were using all of that capacity — in other words, full price for power that is available but not consumed.

Since tenants on average tend to contract for around twice the power they need, Mr. Tazbaz said, those data centers can effectively charge double what they are paying for that power. Generally, the sale or resale of power is subject to a welter of regulations and price controls. For regulated utilities, the average “return on equity” — a rough parallel to profit margins — was 9.25 percent to 9.7 percent for 2010 through 2012, said Lillian Federico, president of Regulatory Research Associates, a division of SNL Energy.

Regulators Unaware

But the capacity pricing by data centers, which emerged in interviews with engineers and others in the industry as well as an examination of corporate documents, appears not to have registered with utility regulators.

Interviews with regulators in several states revealed widespread lack of understanding about the amount of electricity used by data centers or how they profit by selling access to power.

Bernie Neenan, a former utility official now at the Electric Power Research Institute, said that an industry operating outside the reach of utility regulators and making profits by reselling access to electricity would be a troubling precedent. Utility regulations “are trying to avoid a landslide” of other businesses doing the same.

Some data center companies, including Digital Realty Trust and DuPont Fabros Technology, charge tenants for the actual amount of electricity consumed and then add a fee calculated on capacity or square footage. Those deals, often for larger tenants, usually wind up with lower effective prices per square foot.

Regardless of the pricing model, Chris Crosby, chief executive of the Dallas-based Compass Datacenters, said that since data centers also provided protection from surges and power failures with backup generators, they could not be viewed as utilities. That backup equipment “is why people pay for our business,” Mr. Crosby said.

Melissa Neumann, a spokeswoman for Equinix, said that in the company’s leases, “power, cooling and space are very interrelated.” She added, “It’s simply not accurate to look at power in isolation.”

Ms. Neumann and officials at the other companies said their practices could not be construed as reselling electrical power at a profit and that data centers strictly respected all utility codes. Alex Veytsel, chief strategy officer at RampRate, which advises companies on data center, network and support services, said tenants were beginning to resist flat-rate pricing for access to sockets.

“I think market awareness is getting better,” Mr. Veytsel said. “And certainly there are a lot of people who know they are in a bad situation.”

The Equinix Story

The soaring business of data centers is exemplified by Equinix. Founded in the late 1990s, it survived what Jason Starr, director of investor relations, called a “near death experience” when the Internet bubble burst. Then it began its stunning rise.

Equinix’s giant data center in Secaucus is mostly dark except for lights flashing on servers stacked on black racks enclosed in cages. For all its eerie solitude, it is some of the most coveted space on the planet for financial traders. A few miles north, in an unmarked building on a street corner in Mahwah, sit the servers that move trades on the New York Stock Exchange; an almost equal distance to the south, in Carteret, are Nasdaq’s servers.

The data center’s attraction for tenants is a matter of physics: data, which is transmitted as light pulses through fiber optic cables, can travel no faster than about a foot every billionth of a second. So being close to so many markets lets traders operate with little time lag.

As Mr. Starr said: “We’re beachfront property.”

Standing before a bank of servers, Mr. Starr explained that they belonged to one of the lesser-known exchanges located in the Secaucus data center. Multicolored fiber-optic cables drop from an overhead track into the cage, which allows servers of traders and other financial players elsewhere on the floor to monitor and react nearly instantaneously to the exchange. It all creates a dense and unthinkably fast ecosystem of postmodern finance.

Quoting some lyrics by Soul Asylum, Mr. Starr said, “Nothing attracts a crowd like a crowd.” By any measure, Equinix has attracted quite a crowd. With more than 90 facilities, it is the top data center leasing company in the world, according to 451 Research. Last year, it reported revenue of $1.9 billion and $145 million in profits.

But the ability to expand, according to the company’s financial filings, is partly dependent on fulfilling the growing demands for electricity. The company’s most recent annual report said that “customers are consuming an increasing amount of power per cabinet,” its term for data center space. It also noted that given the increase in electrical use and the age of some of its centers, “the current demand for power may exceed the designed electrical capacity in these centers.”

To enhance its business, Equinix has announced plans to restructure itself as a real estate investment trust, or REIT, which, after substantial transition costs, would eventually save the company more than $100 million in taxes annually, according to Colby Synesael, an analyst at Cowen & Company, an investment banking firm.

Congress created REITs in the early 1960s, modeling them on mutual funds, to open real estate investments to ordinary investors, said Timothy M. Toy, a New York lawyer who has written about the history of the trusts. Real estate companies organized as investment trusts avoid corporate taxes by paying out most of their income as dividends to investors.

Equinix is seeking a so-called private letter ruling from the I.R.S. to restructure itself, a move that has drawn criticism from tax watchdogs.

“This is an incredible example of how tax avoidance has become a major business strategy,” said Ryan Alexander, president of Taxpayers for Common Sense, a nonpartisan budget watchdog. The I.R.S., she said, “is letting people broaden these definitions in a way that they kind of create the image of a loophole.”

Equinix, some analysts say, is further from the definition of a real estate trust than other data center companies operating as trusts, like Digital Realty Trust. As many as 80 of its 97 data centers are in buildings it leases, Equinix said. The company then, in effect, sublets the buildings to numerous tenants.

Even so, Mr. Synesael said the I.R.S. has been inclined to view recurring revenue like lease payments as “good REIT income.”

Ms. Neumann, the Equinix spokeswoman, said, “The REIT framework is designed to apply to real estate broadly, whether owned or leased.” She added that converting to a real estate trust “offers tax efficiencies and disciplined returns to shareholders while also allowing us to preserve growth characteristics of Equinix and create significant shareholder value.”

Wednesday, May 15. 2013

Researchers track megacity carbon footprints using mounted sensors

Via SlashGear

-----

Researchers with the NASA Jet Propulsion Laboratory have undertaken a large project that will allow them to measure the carbon footprint of megacities – those with millions of residents, such as Los Angeles and Paris. Such an endevour is achieved using sensors mounted in high locations above the cities, such as a peak in the San Gabriel Mountains and a high-up level on the Eiffel Tower that is closed to tourist traffic.

The sensors are designed to detect a variety of greenhouse gases, including methane and carbon dioxide, augmenting other stations that are already located in various places globally that measure greenhouse gases. These particular sensors are designed to achieve two purposes: monitor the specific carbon footprint effects of large cities, and as a by-product of that information to show whether such large cities are meeting – or are even capable of meeting – their green initiative goals.

Such measuring efforts will be intensified this year. In Los Angeles, for example, scientists working on the project will add a dozen gas analyzers to various rooftop locations throughout the city, as well as to a Prius, which will be driven throughout the city and a research aircraft to be navigated to “methane hotspots.” The data gathered from all these sensors, both present and slated for installation, is then analyzed using software that looks at whether levels have increased, decreased, or are stable, as well as determining where the gases originated from.

One of the examples given is vehicle emissions, with scientists being able to determine (using this data) the effects of switching to green vehicles over more traditional ones and whether its results indicate that it is something worth pursuing or whether it needs to be further analyzed for potential effectiveness. Reported the Associated Press, three years ago California saw 58-percent of its carbon dioxide come from gasoline-powered cars.

California is looking to reducing its emissions levels to a sub-35-percent level over 1990 by the year 2030, a rather ambitious goal. In 2010, it was responsible for producing 408 million tons of carbon dioxide, which outranks just about every country on the planet, putting it about on par with all of Spain. Thus far into the project, both the United States and France have individually spent approximately $3 million the project.

Thursday, May 02. 2013

Cern re-creating first web page to revere early ideals

Via BBC

-----

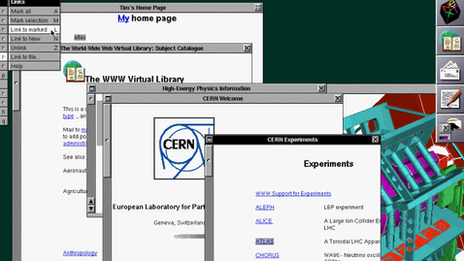

Lost to the world: The first website. At the time, few imagined how ubiquitous the technology would become

A team at the European Organisation for Nuclear Research (Cern) has launched a project to re-create the first web page.

The aim is to preserve the original hardware and software associated with the birth of the web.

The world wide web was developed by Prof Sir Tim Berners-Lee while working at Cern.

The initiative coincides with the 20th anniversary of the research centre giving the web to the world.

According to Dan Noyes, the web manager for Cern's communication group, re-creation of the world's first website will enable future generations to explore, examine and think about how the web is changing modern life.

"I want my children to be able to understand the significance of this point in time: the web is already so ubiquitous - so, well, normal - that one risks failing to see how fundamentally it has changed," he told BBC News

"We are in a unique moment where we can still switch on the first web server and experience it. We want to document and preserve that".

The hope is that the restoration of the first web page and web site will serve as a reminder and inspiration of the web's fundamental values.

At the heart of the original web is technology to decentralise control and make access to information freely available to all. It is this architecture that seems to imbue those that work with the web with a culture of free expression, a belief in universal access and a tendency toward decentralising information.

SubversiveIt is the early technology's innate ability to subvert that makes re-creation of the first website especially interesting.

While I was at Cern it was clear in speaking to those involved with the project that it means much more than refurbishing old computers and installing them with early software: it is about enshrining a powerful idea that they believe is gradually changing the world.

I went to Sir Tim's old office where he worked at Cern's IT department trying to find new ways to handle the vast amount of data the particle accelerators were producing.

I was not allowed in because apparently the present incumbent is fed up with people wanting to go into the office.

But waiting outside was someone who worked at Cern as a young researcher at the same time as Sir Tim. James Gillies has since risen to be Cern's head of communications. He is occasionally referred to as the organisation's half-spin doctor, a reference to one of the properties of some sub-atomic particles.

Amazing dream

Mr Gillies is among those involved in the project. I asked him why he wanted to restore the first website.

"One of my dreams is to enable people to see what that early web experience was like," was the reply.

"You might have thought that the first browser would be very primitive but it was not. It had graphical capabilities. You could edit into it straightaway. It was an amazing thing. It was a very sophisticated thing."

Those not heavily into web technology may be sceptical of the idea that using a 20-year-old machine and software to view text on a web page might be a thrilling experience.

But Mr Gillies and Mr Noyes believe that the first web page and web site is worth resurrecting because embedded within the original systems developed by Sir Tim are the principles of universality and universal access that many enthusiasts at the time hoped would eventually make the world a fairer and more equal place.

The first browser, for example, allowed users to edit and write directly into the content they were viewing, a feature not available on present-day browsers.

Ideals erodedAnd early on in the world wide web's development, Nicola Pellow, who worked with Sir Tim at Cern on the www project, produced a simple browser to view content that did not require an expensive powerful computer and so made the technology available to anyone with a simple computer.

According to Mr Noyes, many of the values that went into that original vision have now been eroded. His aim, he says, is to "go back in time and somehow preserve that experience".

Soon to be refurbished: The NeXT computer that was home to the world's first website

"This universal access of information and flexibility of delivery is something that we are struggling to re-create and deal with now.

"Present-day browsers offer gorgeous experiences but when we go back and look at the early browsers I think we have lost some of the features that Tim Berners-Lee had in mind."

Mr Noyes is reaching out to ask those who were involved in the NeXT computers used by Sir Tim for advice on how to restore the original machines.

AweThe machines were the most advanced of their time. Sir Tim used two of them to construct the web. One of them is on show in an out-of-the-way cabinet outside Mr Noyes's office.

I told him that as I approached the sleek black machine I felt drawn towards it and compelled to pause, reflect and admire in awe.

"So just imagine the reaction of passers-by if it was possible to bring the machine back to life," he responded, with a twinkle in his eye.

The initiative coincides with the 20th anniversary of Cern giving the web away to the world free.

There was a serious discussion by Cern's management in 1993 about whether the organisation should remain the home of the web or whether it should focus on its core mission of basic research in physics.

Sir Tim and his colleagues on the project argued that Cern should not claim ownership of the web.

Great giveawayManagement agreed and signed a legal document that made the web publicly available in such a way that no one could claim ownership of it and that would ensure it was a free and open standard for everyone to use.

Mr Gillies believes that the document is "the single most valuable document in the history of the world wide web".

He says: "Without it you would have had web-like things but they would have belonged to Microsoft or Apple or Vodafone or whoever else. You would not have a single open standard for everyone."

The web has not brought about the degree of social change some had envisaged 20 years ago. Most web sites, including this one, still tend towards one-way communication. The web space is still dominated by a handful of powerful online companies.

A screen shot from the first browser: Those who saw it say it was "amazing and sophisticated". It allowed people to write directly into content, a feature that modern-day browsers no longer have

But those who study the world wide web, such as Prof Nigel Shadbolt, of Southampton University, believe the principles on which it was built are worth preserving and there is no better monument to them than the first website.

"We have to defend the principle of universality and universal access," he told BBC News.

"That it does not fall into a special set of standards that certain organisations and corporations control. So keeping the web free and freely available is almost a human right."

Quicksearch

Popular Entries

- The great Ars Android interface shootout (130805)

- Norton cyber crime study offers striking revenue loss statistics (101318)

- MeCam $49 flying camera concept follows you around, streams video to your phone (99824)

- Norton cyber crime study offers striking revenue loss statistics (57547)

- The PC inside your phone: A guide to the system-on-a-chip (57182)